WINSTON-SALEM — Workers may get a larger tax refund this year because of the Earned Income Tax Credit (EITC). But to get it, you must file a tax return and claim it.

Friday, January 27, 2023, marks the 17th anniversary of EITC Awareness Day, a nationwide effort to increase awareness about EITC and free tax preparation sites. This year, IRS is promoting EITC and providing information on other refundable tax credits that you may be eligible for. This includes the Child Tax Credit (CTC), the Additional Child Tax Credit (ACTC), the Credit for Other Dependents (ODC) and the American Opportunity Tax Credit (AOTC).

Nationwide, as of December 2022, approximately 31 million taxpayers received over $64 billion in EITC. In North Carolina alone, approximately 1 million taxpayers claimed the EITC, receiving over $2.3 billion in EITC. The average amount received by North Carolina taxpayers was $2,094.

If you worked last year and had income of less than $59,187 check out your eligibility for EITC. EITC can mean up to a $6,935 refund when you file a return if you have qualifying children. Workers without a qualifying child could be eligible for a smaller credit up to $560. According to the Internal Revenue Service, the average amount credited for United States taxpayers in 2022 was $2,043.

Why is it important to have an EITC Awareness Day each year? One-third of the EITC population changes each year. The IRS estimates that four out of five workers claim the EITC they earned. This leaves billions of dollars on the table each year. We want to get the word out to those who are eligible to file a tax return even if they don’t owe any tax to claim the EITC. It’s money workers can use for groceries, rent, utilities and other bills.

EITC is complex. It varies by income, family size and your filing status. To be eligible, you must have earned income or certain disability income. This means you must have income from working for someone or working for yourself.

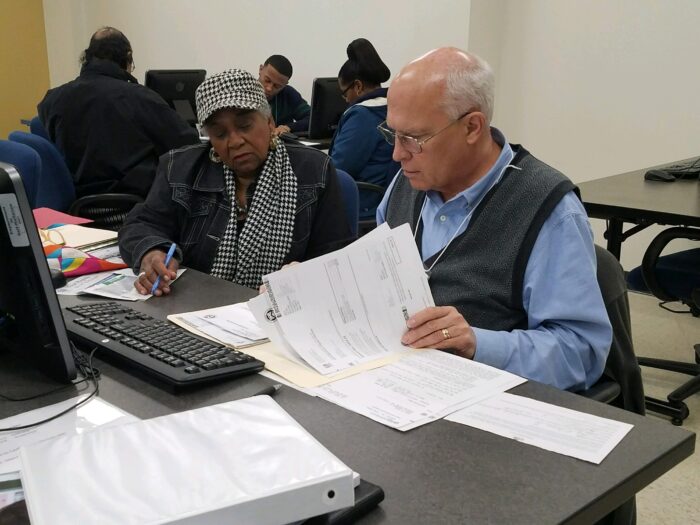

Volunteers – trained by the Internal Revenue Service – ask you the needed questions to find out if you qualify for the EITC and other refundable tax credits. Volunteers at Volunteer Income Tax Assistance (VITA) sites also prepare and e-file (electronically file) your tax return at no cost to you.

If you make less than $60,000, you can get free tax help and return preparation through volunteer sites. IRS-certified volunteers ask the needed questions to find out if you qualify for the EITC and other refundable credits. They also prepare and e-file (file electronically) your return at no cost to you. Forsyth Free Tax offers free tax preparation for people who qualify at the following tax sites:

Experiment in Self-Reliance (ESR)

– Visit www.eisr.org or www.forsythfreetax.com for more information and to schedule an appointment

– You may also call 336-722-9400 ext. 4 to schedule an appointment

– Appointment times are Monday – Thursday, 9 am – 3 pm beginning January 30

– ESR is located at 3480 Dominion Street, Winston-Salem, NC 27105

The Robert Strickland Center at Forsyth Technical Community College (FTCC)

– Visit www.forsythtech.edu/freetaxprep for more information and to schedule an appointment

– You may also call 336-734-7656 to schedule an appointment

– Appointment times are Monday and Wednesday, 2 pm – 8 pm, and Tuesday & Thursday, 10 am – 3 pm beginning January 30

– The Robert Strickland Center is located at 2100 Silas Creek Parkway, Winston-Salem, NC 27103

Please bring the following to your appointment:

– Tax information (W2s, 1099s, receipts for childcare or education expenses, interest statements, and other tax documents).

– Form 1095-A if healthcare coverage is through healthcare.gov.

– Last year’s return, if possible.

– Photo Identification.

– Social Security Cards or ITIN for yourself, your spouse, and your dependents (We cannot accept SSNs not appearing on official documentation).

– Bank Routing Number and Account Number(s) for direct deposit.

– CP01A Notice – IP pin (Identity Protection pin)

—-

ABOUT ESR

ESR is a non-profit Community Action Agency. Its mission is to empower social and economic self-reliance for the working low-income and homeless. Programs serve the working low to moderate income population in Winston-Salem/Forsyth County, helping people locate safe and affordable housing, increase their education, attend financial education classes, have their taxes prepared at no cost and more.

Comments are closed here.